When a marriage or de facto relationship breaks down, it can be a stressful time. Part of this process may involve the separation of assets, which may include the family home, business interests, investments, savings and superannuation. If a mutual agreement cannot be reached, the Court can determine the settlement. Obtaining the right financial and legal advice from a marriage lawyer at the early stages of this process can help a party to navigate their way through the Family Law system and make decisions about their assets and superannuation that provides a better outcome. [...]

Why you should check with a separation lawyer about enforcing a property order against you ex’s superannuation

You may settle your property arrangement with your former partner by agreement, with assistance of a separation lawyer or by judgment of the Court. This may include for property to be transferred to one of you, or for a cash payment made in exchange for an interest in property.

But what happens if you have these orders, but for one reason or another, your former partner has not completed their end of the bargain? What if your former partner is to pay you a certain sum of money by a certain time, but the time comes and goes, with no payment from them? What if, after seeking legal advice from a separation lawyer and looking to enforce the orders, you find they have no means of payment? If they have no substantial assets, can you make an application to the Court and seek the monies they have agreed to give you are taken from their superannuation? [...]

Superannuation and Family Law Lawyers

For most working Australians, superannuation is the largest asset they will have outside of owning their home. The amount of superannuation that an individual has will largely depend on their employment history and earnings.

How does this relate to divorce and separation?

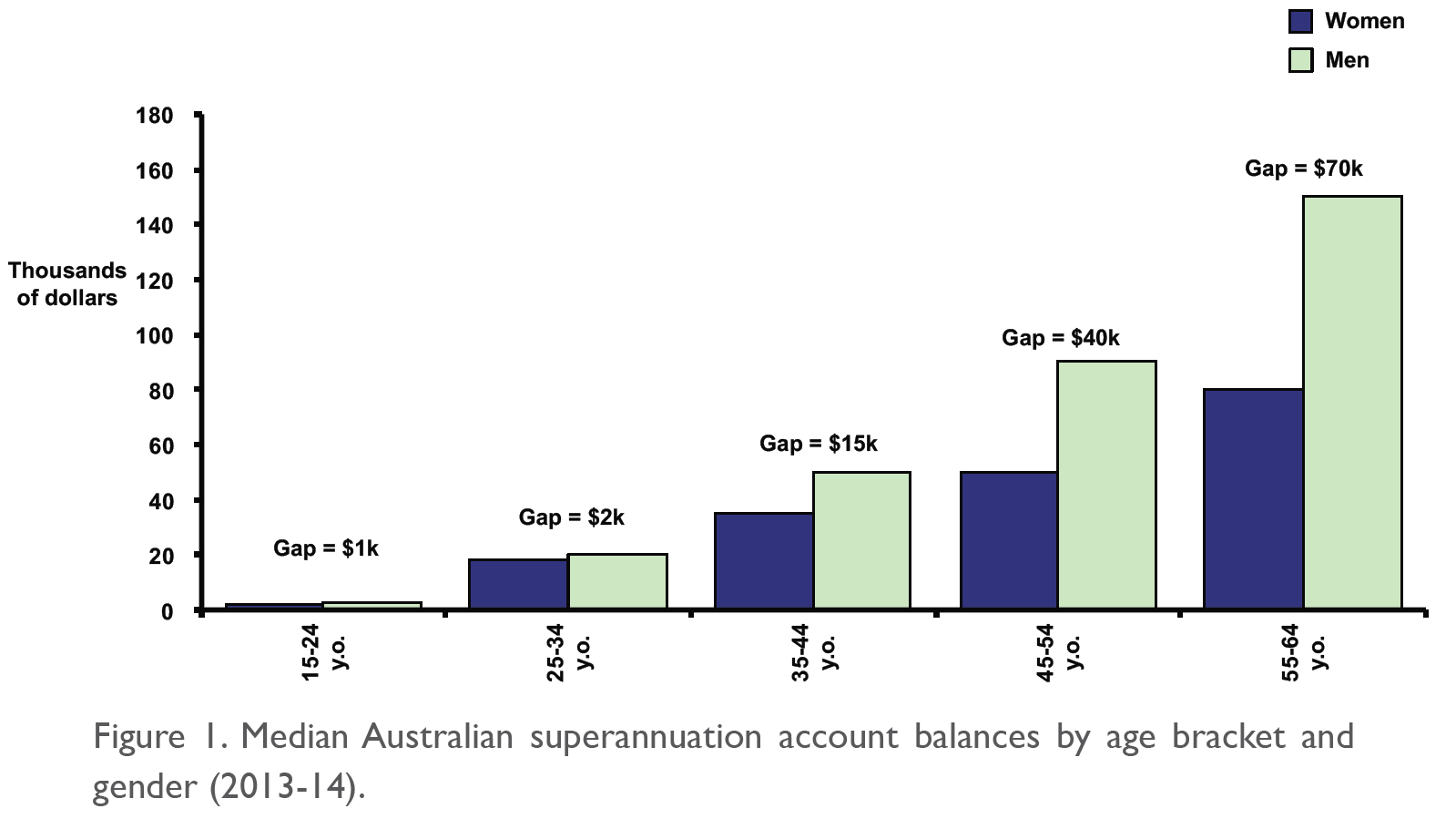

A recent research report by David Hetherington and Warwick Smith from ‘Per Capita’ has noted how women’s superannuation generally accrues at a lower rate than men’s. See Figure 1 below which highlights data from the Australian Bureau of Statistics.

The report notes that superannuation benefits accrue in direct proportion to income received. It is often the case that women spend less time in the workforce and so do not have the same opportunity as men to contribute towards their superannuation. Reduced time within the workforce is attributable to various factors including taking time off work to care for young children, carer responsibilities such as taking children to and from school and caring for children when they are sick. Other relevant factors include the cost and availability of childcare. All of these contributing factors often lead to an increased likelihood of being engaged in part-time or casual employment. Clearly these factors would also apply to fathers who carry out a primary care role. [...]